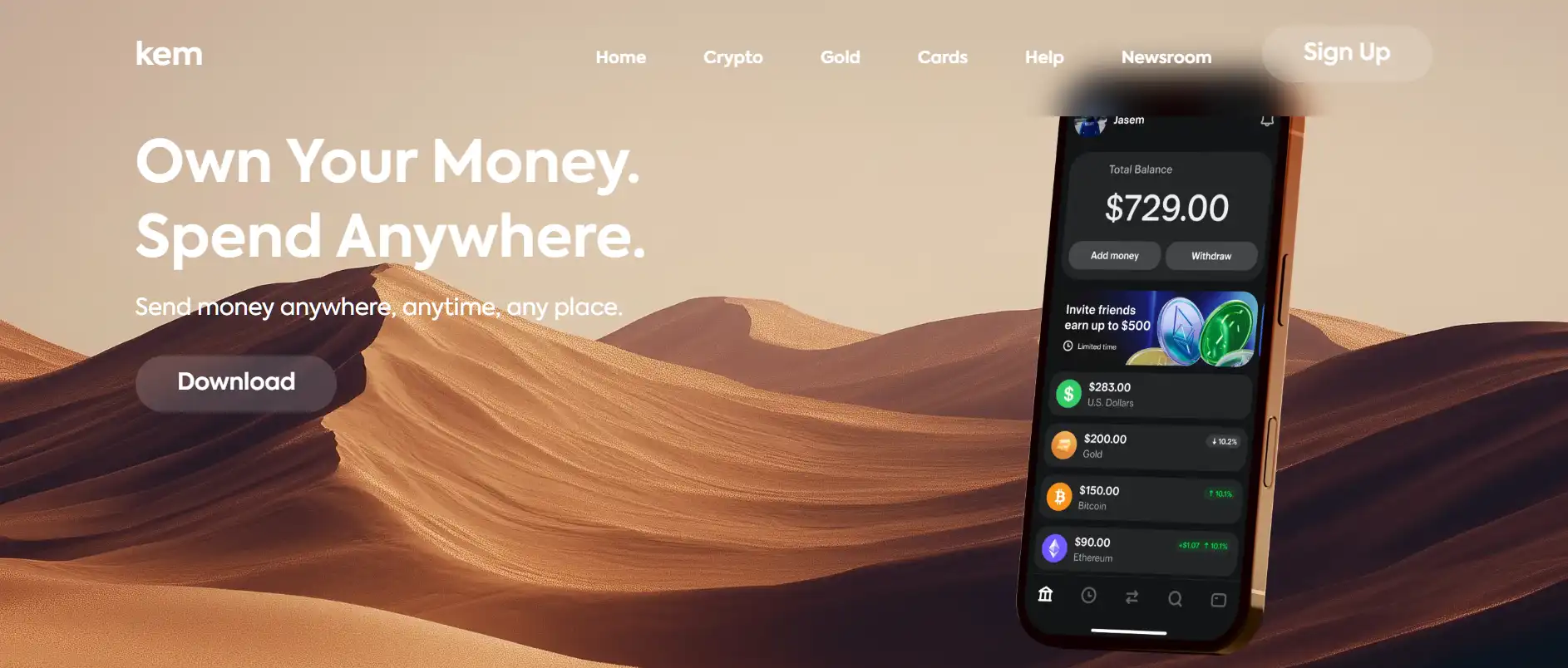

The world of finance is rapidly evolving: cryptocurrencies are no longer a niche tool, and digital assets are becoming the foundation of international settlements. Against this backdrop, Kem has emerged — a project that calls itself a stablecoin superbank. Its goal is to combine the simplicity of traditional banking operations with the advantages of blockchain: instant transfers, low fees, security, and transparency. Kem allows users to store, spend, and invest funds in stablecoins, tokenized gold, and other digital assets, creating a bridge between traditional and decentralized finance.

- Mission and philosophy of the Kem project

- Technological structure and integrations

- Functions and products of the platform

- Security and regulation

- Kem’s market position and growth prospects

Mission and philosophy of the Kem project

Kem emerged as a response to the challenges of the traditional financial system — limited access to banking services, slow international transfers, and high fees. The project positions itself as a next-generation digital bank, where users can manage their assets without intermediaries or borders.

Main principles of Kem:

-

Accessibility. Anyone, even without a bank account, can send and receive funds.

-

Speed. Transfers are executed in seconds thanks to blockchain networks.

-

Stability. The project’s economy is based on stablecoins USDT and XAUT, protected from volatility.

-

Transparency. All operations and reserves are recorded on the blockchain.

-

Global reach. Kem removes barriers between countries, currencies, and financial systems.

Thanks to a $3 million investment from Tether Operations Limited and collaboration with TRON DAO, the project has gained the technological and financial foundation to enter the markets of the Middle East and North Africa — regions where millions of people rely on fast, affordable transfers every day.

Technological structure and integrations

Kem uses a hybrid model that combines centralized and decentralized technologies. The architecture is designed to give users control over their funds while providing reliability comparable to traditional banking infrastructure.

At the core of the ecosystem is LayerZero, enabling interaction between multiple blockchains — TRON, Ethereum, and Arbitrum. This ensures cross-chain asset transfers without the need for third-party bridges. For secure storage, the platform uses Fireblocks, which provides multi-signature protection and institutional-grade security.

Kem also integrates Chainalysis to monitor transactions and detect suspicious activity, while the built-in Roomie AI helps users plan expenses, analyze budgets, and select profitable saving strategies. This architecture makes the project stable, scalable, and convenient for users of all experience levels.

Functions and products of the platform

Kem offers a comprehensive suite of services, turning it into a true digital banking ecosystem. The table below outlines the key products and their purposes:

| Product / Feature | Purpose | Value for the User |

|---|---|---|

| Kem Wallet | Storage of stablecoins, gold, and cryptocurrencies | Centralized wallet with instant access |

| Instant Transfers | Peer-to-peer transfers without fees | Simple international transactions |

| Kem Card | Physical and virtual payment card | Online and offline purchases using crypto balance |

| Tokenized Gold (XAUT) | Digital gold savings | Inflation protection with real asset backing |

| Savings Product | Interest-bearing savings via DeFi integrations | Passive income with minimal effort |

| AI Assistant | Tips, analytics, and financial recommendations | Personal smart finance advisor |

This ecosystem unites different aspects of the digital economy: transfers, savings, investments, and payments. Kem makes cryptocurrency a practical everyday tool while maintaining the simplicity and usability of modern financial applications.

Security and regulation

Kem understands that user trust is the key to success for any financial platform. From the beginning, the project was built with a focus on legal transparency and technical security. The managing company, Kemfinity s.r.o., registered in the Czech Republic, holds a VASP license allowing it to provide virtual asset services within the EU.

The platform uses Proof of Reserves to verify token backing, ensuring that digital gold and stablecoins are fully collateralized. The KYC/AML system complies with international standards, preventing misuse for illicit activities.

Moreover, Kem employs a three-tier security model: Fireblocks for custody, Chainalysis for monitoring, and Roomie AI for adaptive risk detection. This approach makes the project competitive in a market where transparency and safety define user confidence.

Kem’s market position and growth prospects

Kem occupies a unique niche between crypto projects and neobanks. Unlike classic exchanges or wallets, it provides an ecosystem where digital assets serve everyday financial purposes rather than speculation. The main target regions are the Middle East, North Africa, and developing countries, where millions of users rely on cross-border transfers.

Partnerships with Tether, TRON DAO, and Dinari strengthen the project’s position by expanding access to tokenized stocks, gold, and new yield instruments. In the future, Kem plans to broaden its product range, introduce microloans and insurance, and integrate DeFi protocols for higher savings returns.

By combining stablecoin reliability, cross-chain interoperability, and a seamless user experience, Kem has the potential to become a leading player in the Web3 finance sector, offering users a true alternative to traditional banking.