The concept of altcoin season often attracts crypto investors, as it seems to have the potential to occur after a successful Bitcoin halving.

In recent times, the crypto market has experienced a lot of volatility, particularly in the past month, with altcoins losing significant value amid concerns about the halving event.

Leading crypto analyst Ali Martinez recently pointed out that historically, altcoin season tends to begin shortly after a Bitcoin halving. This historically serves as a catalyst for changing market dynamics, influencing not only Bitcoin but other cryptos as well.

Characteristics and Duration of Altcoin Season

Altseason is characterized by a rapid and substantial increase in the altcoin market capitalization relative to Bitcoin. This phenomenon is usually short-lived, often not exceeding a few months, as capital flows back to Bitcoin or exits the crypto market entirely.

During such a season, investors shift their focus from Bitcoin to altcoins, speculating on their potential for higher returns.

AMBCrypto reported that at the beginning of 2024, the altseason index, which tracks the performance of altcoins against Bitcoin, rose above 75, indicating a strong altcoin market.

However, following the recent halving, this index plummeted to around 25, reflecting what is commonly known as the Bitcoin season, where focus and gains primarily support Bitcoin.

Nevertheless, it is noted that altcoins have depreciated significantly more than Bitcoin during this period, likely due to increased selling pressure and market fears.

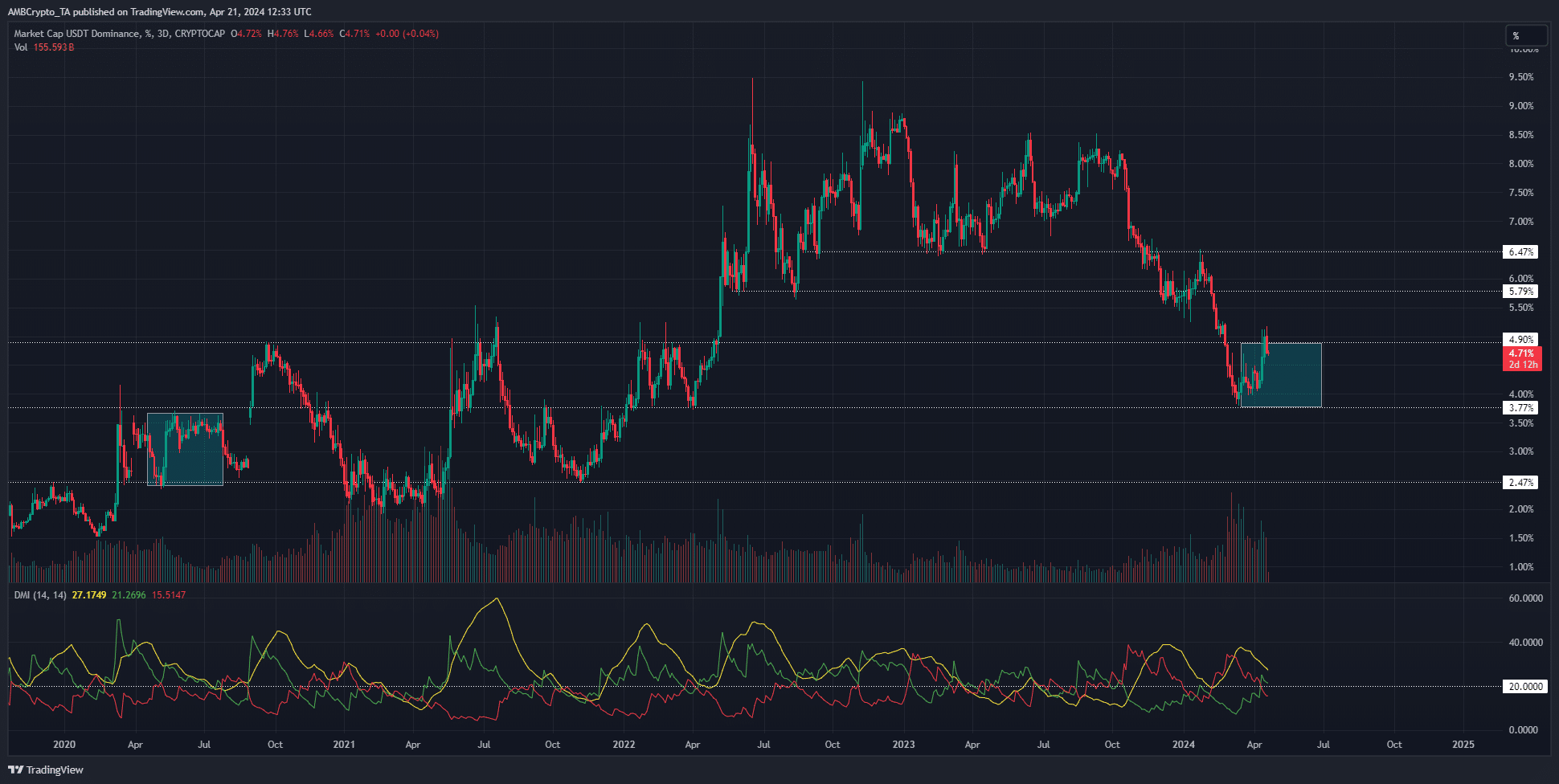

Currently, the index stands at 39, indicating that we are not in an altcoin season. This observation is supported by an analysis of the dominance of Tether (USDT) in the market. Tether, a leading stablecoin, often serves as a barometer for risk sentiment in the crypto market.

A decrease in USDT dominance usually indicates investor willingness to take on more risk by purchasing cryptos other than stablecoins.

The downward trend in USDT dominance, observed from late October to early April, suggests that investors have shifted capital from stablecoins to more volatile crypto assets.

This movement is a characteristic of the approaching altcoin season, as it indicates a shift in investor sentiment towards taking greater risks.